Real estate is the world’s largest asset class, worth $230 trillion – bigger than the global stock market. This massive market gives investors a chance to earn predictable income with tax benefits, but nobody succeeds without learning the ropes first.

I found that there was too much confusion when searching for the right real estate investing course. Most traditional schools and programs leave out everything in real estate investing. They skip topics like market analysis, networking strategies, and property management that work.

These 15 tips about choosing a real estate investing course will help you – they’re the things most schools won’t mention. You’ll learn to pick education that brings results, whether you want to learn online or in a classroom.

Research Multiple Course Providers

Image Source: Bankers By Day

You need to evaluate multiple providers carefully to choose a real estate investing course that gives you the best value for your money.

Course Provider Reputation

The instructor’s expertise is a vital factor in choosing a real estate investing course. The best instructors blend teaching abilities with hands-on property investment experience. The most reputable programs have instructors who stay active in real estate transactions. This gives students fresh market insights instead of dated theories.

Student Success Rates

The effectiveness of real estate courses shows in their student performance data. The best programs maintain high completion rates, and some report average success rates of 64% across terms. Their strong track records prove that 90% of students find jobs through internship connections.

Course Provider Pricing Models

Course prices vary by a lot between providers. Harvard Extension School charges $3,340 per real estate investment course. Other platforms let you access self-study programs for $39 monthly. You’ll find several flexible payment options:

- Self-paced online courses: $19.99 to $59.99

- Professional certification programs: $650 annual membership

- Workshop-based learning: $99 monthly with coaching

The secret is to match the pricing model with your budget and learning style. Many institutions help make quality real estate education available through scholarships and financial aid.

Verify Course Accreditation Status

Image Source: Goodegg Investments

Professional certifications are the foundations of credible real estate education. Real estate investing courses offer two types of credentials: designations that need yearly dues and certifications that need just one-time application fees.

Industry Recognition

The National Association of REALTORS® (NAR) leads real estate education accreditation. NAR’s affiliated programs need active membership and follow strict educational standards. Harvard Extension School awards certificates to students who complete four graduate-level courses with a B grade or higher within three years.

Certification Value

Real estate professionals can realize their potential through industry certifications. These credentials help them access exclusive networks, get higher-profile listings, and speak at industry events. Many jurisdictions require specific real estate courses to get licenses.

Accreditation Standards

Programs must meet tough quality standards to get accredited. Harvard’s certification needs students to complete four graduate-level courses. The program focuses on:

- Investment principles and techniques

- Market analysis methodologies

- Deal structuring fundamentals

- Asset management strategies

The Center for REALTOR Development requires students to score at least 70% on certification exams. MIT’s Professional Certificate Program needs three years of industry experience, and students must complete it within 16 months. These requirements ensure certified professionals have both theory knowledge and hands-on expertise.

Compare Course Curriculum Depth

Image Source: Ippei

A complete curriculum serves as the foundation of any good real estate investing course. My analysis of several leading programs reveals the key components that provide the most value.

Core Topics Coverage

Top institutions build their curricula around both micro and macro points of view in real estate investment. The best programs include:

- Financial economic principles and valuation methods

- Space market analysis and portfolio management

- Investment analysis and development projects

- Capital structures and tax considerations

Practical Applications

The best courses put hands-on experience first through financial modeling and case studies. Students at prestigious schools work on real-life exercises to analyze cash flows, determine property values, and measure economic returns. This practical approach helps bridge the gap between theory and actual market scenarios.

Learning Resources

Today’s real estate investing courses employ various learning tools to boost understanding. Videos and infographics work together with traditional study guides to create a rich learning experience. Many programs’ discussion forums and direct access to industry professionals make shared learning possible. These tools help students become skilled at complex concepts like debt structures, market analysis, and investment strategies through hands-on practice.

Course content depth varies substantially between providers. Some offer simple theoretical knowledge while others provide complete technical training over 8-9 weeks. A course’s curriculum structure becomes a vital factor when choosing one that matches your investment goals.

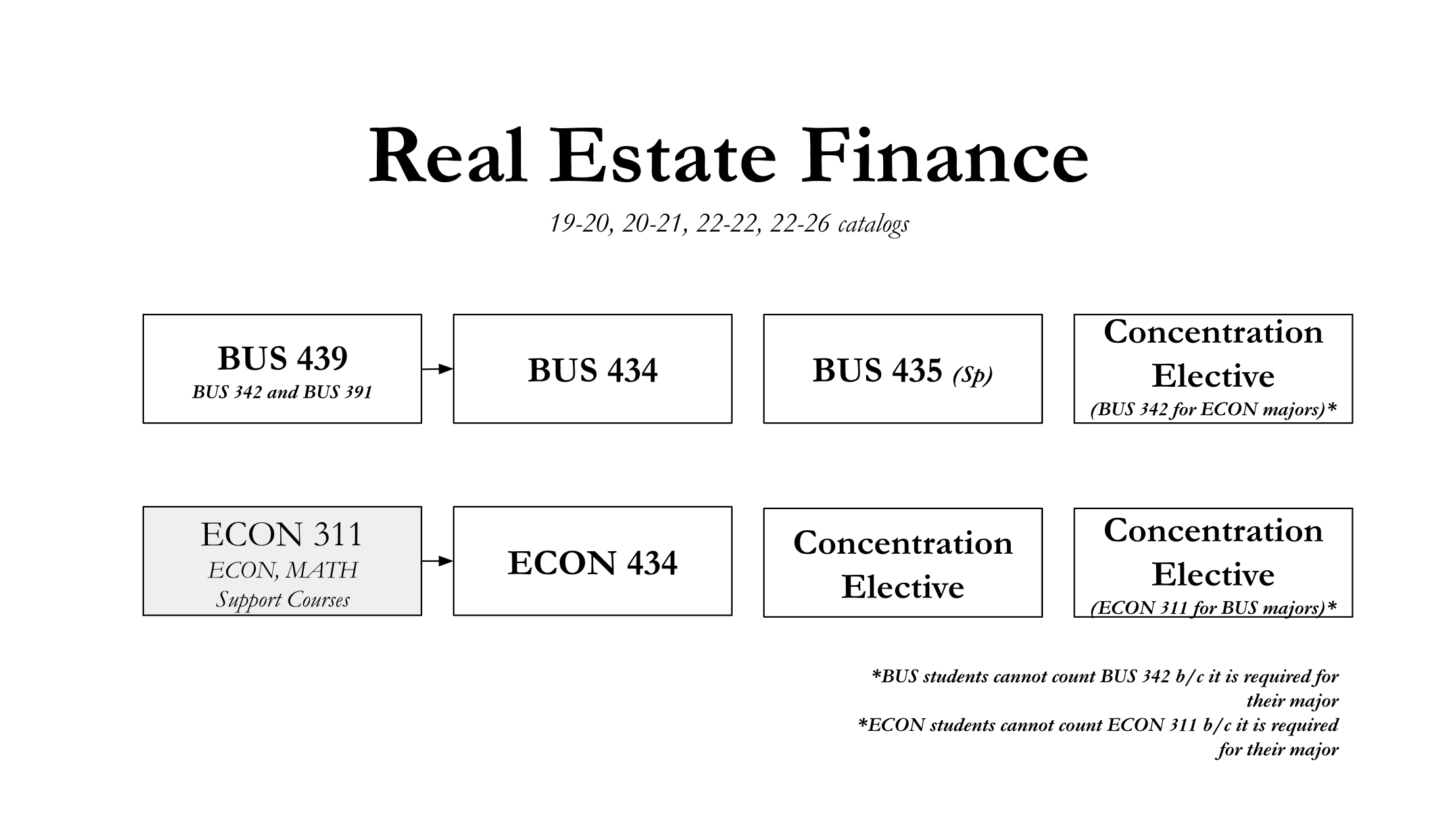

Evaluate Learning Format Compatibility

Image Source: Bankers By Day

Your choice between online and traditional classroom formats will shape how you learn in a real estate investing course.

Online vs In-Person Options

Online courses give you a unique experience with access to materials whenever you want, anywhere you have internet. Traditional classroom settings create a structured environment where you interact with instructors and get feedback right away. Both formats maintain equal educational quality but differ in how they deliver content and let you set your pace.

Learning Style Assessment

Your learning priorities play a vital role in course success. Today’s real estate programs support four main learning approaches:

- Visual learners through multimedia content

- Auditory learners via lectures

- Kinesthetic learners through practical exercises

- Reading/writing learners with complete study materials

Time Commitment Requirements

Dedicated learners can finish full-time programs in several weeks to months. Part-time options work well for students who juggle other responsibilities over longer periods. Like in self-paced online formats, students pick up right where they stopped, and tracking tools show their progress. Programs typically give you six months of access beyond subscription models. This ensures you have enough time to learn everything thoroughly.

Check Instructor Credentials

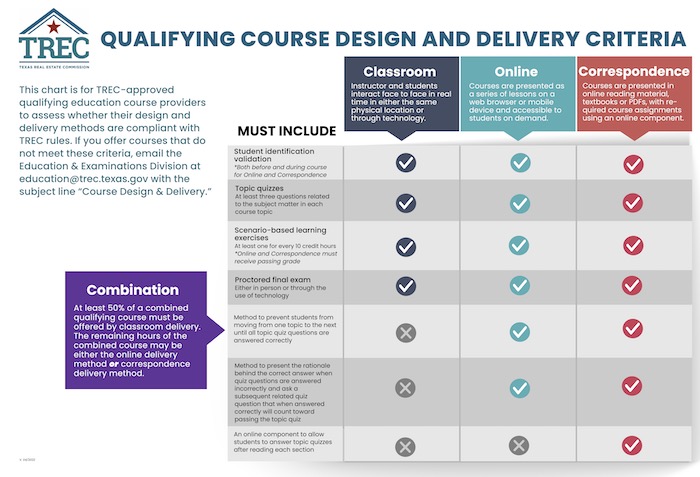

Image Source: TREC – Texas.gov

Quality real estate investing courses depend on instructor credentials as their life-blood. A program’s potential value becomes clear when we look at an instructor’s background.

Real Estate Experience

The best instructors stay active in property investments. In fact, effective teachers blend at least five years of active broker experience with proven transaction records. Leading instructors have completed hundreds of real estate deals that focus on residential and commercial properties.

Teaching Background

The finest instructors combine academic qualifications with practical teaching skills. They need to show three years of teaching or training experience. Top programs feature instructors who:

- Hold advanced degrees in real estate or related fields

- Maintain current market knowledge

- Excel in classroom management

- Become skilled at interactive teaching techniques

Industry Recognition

Professional recognition boosts an instructor’s credibility. Top instructors often belong to prestigious organizations like The National Association of REALTORS®. Distance education certifications, such as the Certified Distance Education Instructor (CDEI) designation, verify an instructor’s expertise in online teaching. Regular assessments from The International Distance Education Certification Center (IDECC) ensure these standards remain high.

Review Student Support Services

Image Source: Newbie Real Estate Investing

Support services are the foundations of success in any real estate investing course. These services include individual-specific guidance, technical assistance, and networking opportunities.

Mentorship Programs

Expert-led mentorship programs deliver custom guidance through several formats:

- One-on-one coaching with direct access to industry veterans

- Group mentorship sessions with peer learning opportunities

- Bimonthly coaching sessions to deepen understanding

- Apprenticeship programs with hands-on training

Technical Support

The detailed technical assistance has 24/7 access to online resources and dedicated help centers. Students get unlimited access to educational materials, downloadable resources, and professional guidance throughout their course. Many programs also provide video-chat tutoring with experienced real estate professionals.

Community Access

Quality programs help create connections through exclusive online communities and networking events. Students can participate with peers, share experiences, and build professional relationships on these platforms. Graduates get access to alumni networks through dedicated LinkedIn groups and local Slack channels after completing the course. Some institutions also organize cross-program events where students connect with professionals from investment banking, private equity, and venture capital sectors.

Assess Practice Tools Availability

Image Source: AcademyOcean

Quality real estate investing courses equip students with tools they need to analyze markets and learn practical skills.

Real Estate Investment Software

The best courses feature Stessa and RealData software platforms to help with investment analysis. These tools let students:

- Track rental property performance

- Analyze potential deals

- Monitor portfolio financials

- Generate tax reports

- Process tenant applications

Market Analysis Tools

Students get access to professional-grade analysis platforms during their training. The National Association of Realtors research portal offers current housing trends and metro data. NeighborhoodScout examines more than 600 neighborhood characteristics in 61,000 locations. These platforms help students learn about investment opportunities through detailed demographic data and market trends.

Financial Calculators

Investment analysis depends on accurate financial calculations, so courses require specific calculator models. The HP10bII+ calculator remains the industry’s standard tool for solving complex time-value problems. Some programs also offer custom Excel spreadsheets for investment scenarios. Students become skilled at essential calculations that include:

- Internal rate of return

- Net present value

- Loan amortization

- Capital accumulation

Examine Real-World Case Studies

Image Source: BiggerPockets

Case studies serve as effective learning tools in real estate investing courses. Students head over to exploratory sessions to learn about real-life scenarios and develop innovative solutions to strategic challenges.

Success Stories

We studied investors who turned single properties into profitable portfolios. A remarkable case shows how an investor traded one San Francisco property for twenty cash-flowing properties. This move boosted monthly income from zero to USD 20,000. There’s another reason to feel inspired – a couple built a thirteen-property portfolio that generates USD 12,841 monthly by choosing the right markets.

Failed Investment Analysis

Learning from investment failures brings equal value. Many investors lose more than USD 20,000 on renovation costs because they rush through property inspections. New investors often stumble by not running their investments like businesses. They lack proper systems to communicate with tenants and manage finances.

Market Scenarios

Real estate courses use market scenarios of all types to boost learning. Students analyze multifamily acquisitions, office investments, and retail properties through detailed case studies. These scenarios help students become skilled at:

- Transaction structuring techniques

- Investment underwriting methods

- Due diligence processes

- Market analysis strategies

Case studies are the foundations of connecting theory with real-life application, which prepares students to make investment decisions. These immersive learning experiences give investors confidence to analyze and execute real estate deals in a variety of market conditions.

Consider Networking Opportunities

Image Source: Wisconsin School of Business – University of Wisconsin–Madison

Networking plays a vital role in real estate investing success. A recent study shows 63% of professionals credit their achievements to strong networking.

Industry Connections

Professional organizations create structured ways to build industry relationships. Groups like the Urban Land Institute (ULI) and Commercial Real Estate Women (CREW) connect you with industry professionals. These organizations host events, webinars, and forums throughout the year. Real estate investors can share ideas and find new opportunities at these gatherings.

Alumni Network

Alumni networks build strong post-course communities. The Cornell Real Estate Council represents one of the largest university-based real estate professional networks. Graduates can join exclusive LinkedIn groups and local Slack channels to continue networking. These platforms help professionals connect across investment banking, private equity, and venture capital sectors.

Partnership Possibilities

Real estate partnerships combine multiple investors’ strengths to create better success opportunities. Two main types of partnerships exist:

- Active partnerships: Equal responsibility for daily management

- Passive partnerships: Capital investment with limited involvement

Successful partnerships need clear expectations about duties from day one. Partners bring different views to key business decisions that often lead to better outcomes. Finding partners through real estate courses who complement your strengths and weaknesses helps you avoid future venture pitfalls.

Analyze Cost vs Value Proposition

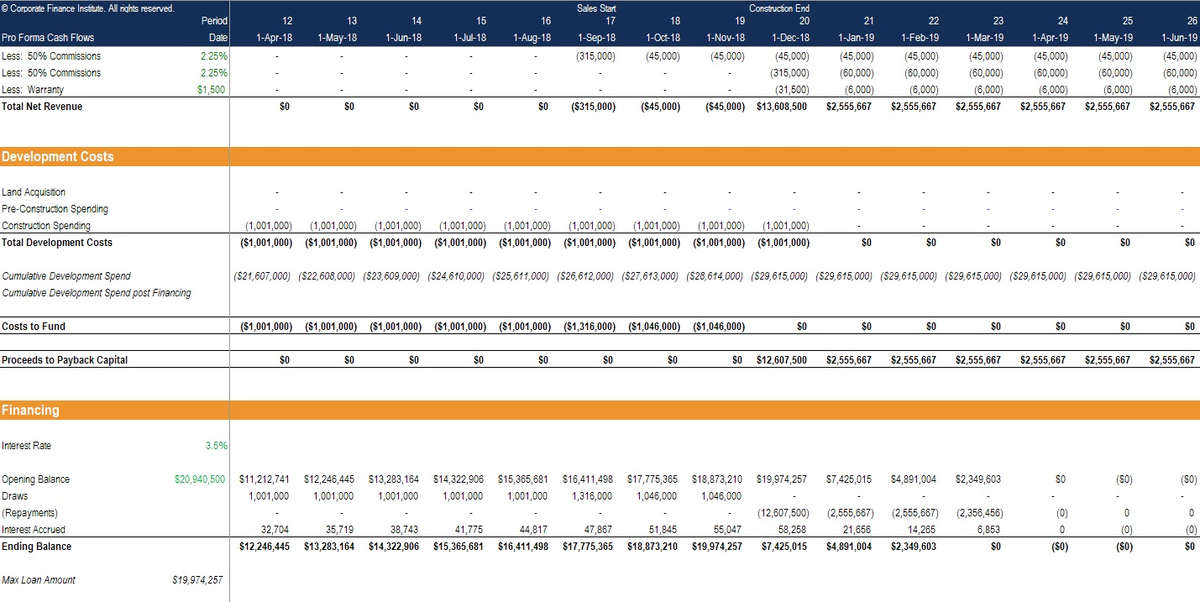

Image Source: Corporate Finance Institute

Real estate education requires a careful look at costs versus potential returns. Course prices across the industry range from $97 simple training sessions to complete packages that cost up to $50,000.

Course Investment

Programs come with different price tags to fit various budgets and learning styles. We found entry-level online courses starting at $109. Professional certification programs cost more:

- Self-paced courses: $126 for members, $187 for non-members

- Two-day campus programs: $2,990

- Eight-week intensive programs: $5,000

ROI Potential

Quality programs provide more than just theoretical knowledge. They give you practical tools to calculate returns, such as:

- Cash-on-cash rate analysis

- Value improvement metrics

- Net present value calculations

- Internal rate of return assessments

Hidden Costs

Extra expenses often pop up during your learning experience. You should plan for:

- Course materials and required software

- Membership fees for professional organizations

- Travel expenses for in-person sessions

- Technology requirements for online learning

Successful programs help students manage costs with flexible payment options. Monthly installments and tuition assistance programs make education more accessible. Success comes from choosing a program that matches your financial situation and investment goals.

Look for Hands-On Training

Image Source: Udemy

Real estate investing success depends on hands-on experience more than theoretical knowledge.

Practical Exercises

Students participate in interactive exercises that help them become skilled at investment fundamentals. These sessions focus on expandable solutions and applicable techniques to analyze properties. Students work with underwriting templates and marketing packages to build their professional expertise alongside traditional learning methods.

Field Trips

Field trips are a great way to get a close look at potential investments. Experienced investors lead property tours in Belize that focus on market exploration without sales pressure. Jacksonville’s field trips span two full days and let investors see property dynamics up close.

Real Deal Analysis

The training for deal analysis includes complete underwriting processes and market review techniques. Students learn to:

- Analyze marketing packages and extract key information

- Review rental and sales comparables

- Assess micro-market conditions

- Calculate debt servicing effects

- Review rent rolls and T-12 statements

Columbia Business School’s program shows this approach through a six-week hands-on learning experience. Students apply value investing principles to real estate scenarios. These practical components prepare investors for ground market conditions and move beyond theory to applicable investment strategies.

Verify Update Frequency

Image Source: Harvard Professional Development – Harvard University

Real estate investing courses must keep up with market changes to succeed. New laws, regulations, and trends keep emerging in the real estate industry.

Current Market Trends

Real estate courses adapt to changing market conditions. We focused on new technologies and customer priorities. Courses in 2024 include PropTech innovations and artificial intelligence applications in property markets. Programs now teach Single Family Home investing strategies. They also cover how autonomous vehicles affect property values.

Updated Materials

The best courses keep their content fresh with regular updates:

- Market analysis tools and financial models

- Property valuation methodologies

- Investment strategy frameworks

- Risk assessment techniques

- Regulatory compliance guidelines

Industry Changes

Course materials reflect how the real estate sector has changed to meet new challenges. Customer priorities have changed because of environmental awareness over the last several years. Courses now teach green building practices, energy-efficient features, and smart home technologies. Co-living, co-working, and blockchain technologies have altered the map of traditional property management.

Success in real estate remains challenging. Regular course updates play a key role in student success. Students learn better and feel more satisfied with programs that maintain current content.

Check Post-Course Support

Image Source: Azibo

Success in real estate investing education depends on the support you get after completing your course. Quality programs give you the resources that go beyond your original training period.

Ongoing Resources

During your learning experience, you get 24/7 access to online resources and dedicated help centers. Digital study materials include self-check quizzes, simulations, and detailed video libraries. Among other resources, cloud-based property management software makes tasks like tenant screening and lease management easier.

Career Guidance

Students grow professionally through structured mentorship programs and industry connections. Harvard Extension School offers stackable credential pathways that let students advance from certificates to master’s degrees. Graduates can join exclusive LinkedIn groups and local alumni Slack channels for regional networking.

Continued Learning

Post-licensing education drives professional growth in real estate. The ever-changing world of real estate means you just need to keep your knowledge and skills current. Programs typically cover:

- Business planning strategies

- Advanced marketing techniques

- Transaction management

- Prospecting methods

Continuous education gives you the tools to direct regulatory changes and market developments. Post-course support helps investors keep their competitive edge while building green careers in real estate.

Review Payment Flexibility

Image Source: Steadily

Real estate investing courses today come with different payment options that work for everyone’s budget.

Payment Plans

Students can choose from several flexible payment options through platforms like Sezzle and Affirm. Here are the available payment structures:

- Two-week split: 50% upfront, 50% in week 2

- Six-week split: 25% payments every two weeks

- Monthly installments: 3 to 48-month terms with interest rates from 0-36% APR

Refund Policies

Each course has its own refund policy based on the format. Online programs will give you a 100% refund within three calendar days after you register. In-person intensive courses offer 50% refunds before the third scheduled session.

Financial Aid Options

Students can access various financial assistance programs among other payment methods. Federal subsidized loans help cover educational costs for eligible students and defer interest payments during enrollment. Scholarships are available to students who show financial need or meet specific GPA requirements. Many aspiring investors also get their employers to sponsor them. Brokers often cover tuition costs in exchange for working with them after graduation.

You should take a closer look at the payment terms before signing up. Some programs add administrative fees of USD 9.99 per payment. Others need a minimum purchase of USD 100 to qualify for payment plans. The right payment option will give you a smooth learning experience without any money stress.

Investigate Success Guarantees

Image Source: Orfalea College of Business – Cal Poly

Real estate investing courses offer varying levels of success guarantees that differ substantially from provider to provider.

Pass Rate Guarantees

AceableAgent boasts a national pass rate of 91%. Their state-specific success rates reach 95% in Florida and 93% in New York. Quality programs now include first-time pass guarantees on state exams. The CE Shop equips students with detailed exam preparation tools such as quizzes, flashcards, and practice tests.

Money-Back Policies

Trusted online programs offer money-back guarantees with these conditions:

- Students must score 80% on simulated exams before taking state licensing test

- Practice exams need completion within five days of state test

- Students should submit failure notice and score breakdown to analyze

- Refund requests must be made within three days of registration

Success Metrics

The Federal Trade Commission keeps watch over course provider performance and takes action against programs that make empty promises. Their actions in 2023 resulted in USD 324 million returned to consumers. Student achievement rates and post-course performance tracking are the foundations of success metrics. Quality programs exploit benchmark data and long-term financial goals to track student progress effectively.

Comparison Table

| Tip | Key Focus | Notable Features | Cost Range | Timeline | Success Metrics |

|---|---|---|---|---|---|

| Find Multiple Course Providers | Quality assessment | Instructor expertise, Student performance tracking | $19.99-$3,340 | N/A | 64% completion rate |

| Check Course Accreditation Status | Professional certification | NAR affiliation, Industry recognition | N/A | 3 years for completion | 70% minimum score requirement |

| Look at Course Curriculum Depth | Educational content | Financial modeling, Case studies, Market analysis | N/A | 8-9 weeks | N/A |

| Match Learning Format Compatibility | Learning style fit | Online/In-person options, Flexible scheduling | N/A | 6 months access | N/A |

| Review Instructor Credentials | Teaching quality | Active market participation, Professional certifications | N/A | N/A | 5+ years experience required |

| Look into Student Support Services | Learning assistance | One-on-one coaching, Group mentorship, 24/7 resources | N/A | Bi-monthly sessions | N/A |

| Check Practice Tools Availability | Ground application | Investment software, Market analysis tools, Financial calculators | N/A | N/A | N/A |

| Study Real-life Case Studies | Practical learning | Success stories, Failure analysis, Market scenarios | N/A | N/A | $20,000 monthly income examples |

| Explore Networking Opportunities | Professional connections | Industry groups, Alumni networks, Partnership possibilities | N/A | N/A | 63% success correlation |

| Study Cost vs Value Proposition | Investment return | Various pricing tiers, ROI calculation tools | $97-$50,000 | N/A | N/A |

| Get Hands-On Training | Practical experience | Field trips, Deal analysis, Interactive exercises | N/A | 6 weeks | N/A |

| Check Update Frequency | Content currency | Market trends, Updated materials, Industry changes | N/A | Annual updates | N/A |

| Find Post-Course Support | Ongoing assistance | 24/7 resource access, Career guidance, Continued learning | N/A | N/A | N/A |

| Look at Payment Flexibility | Financial options | Payment plans, Refund policies, Financial aid | $100 minimum | 3-48 months | 0-36% APR |

| Study Success Guarantees | Performance assurance | Pass rate guarantees, Money-back policies | N/A | 3-day refund window | 91-95% pass rate |

Conclusion

Choosing the right real estate investing course requires evaluation from multiple angles. After analyzing 15 key tips, I found that successful education blends theory with real-life application. Quality programs have complete curricula, experienced instructors, and reliable support systems that build a foundation for future success in real estate investing.

Students get better results by picking courses that match their learning style and provide ground experience through case studies and field trips. My research indicates programs with strong networking and post-course support create higher success rates, especially when you have verified pass rates of 91-95%.

The right real estate education is worth every penny as it boosts market understanding and cuts investment risks. Students should look for programs with flexible payment options ($97-$50,000 range) that don’t compromise on key features like accreditation, updated content, and practical tools.

Your success in real estate investing begins with the right educational foundation. These tips help you pick courses that deliver value beyond traditional classroom learning. Note that the best investment in real estate starts with quality education that aligns with your goals and learning style.